The trading volume of the first cryptocurrency on the 22 largest cryptocurrency exchanges increased by 61% in the first quarter of 2020 compared to the previous quarter.

According to The Block research, the bitcoin trading volume in January-March 2020 exceeded $154 billion, that is 61% higher than the trading volume in the fourth quarter of 2019, when it reached only $96 billion.

The list of cryptocurrency exchanges whose data was taken into account in the study includes such trading platforms, as Binance, Bitfinex, bitFlyer, Bitstamp, Bittrex, Coinbase Pro, Gemini, itBit, Kraken, Poloniex, LMAX Digital, Bitbank, Coincheck, Zaif, Huobi, OKEx, Bithumb, Upbit, KuCoin, Coinfloor, Liquid, and Gate.io.

Despite increasing trading volumes, the dollar equivalent of transactions in the bitcoin network in the first quarter of 2020 increased relatively insignificantly, by 11% compared to the previous quarter. During the first quarter, users carried out transactions with BTC worth more than $178 billion. On average, they performed $1.98 billion in operations per day.

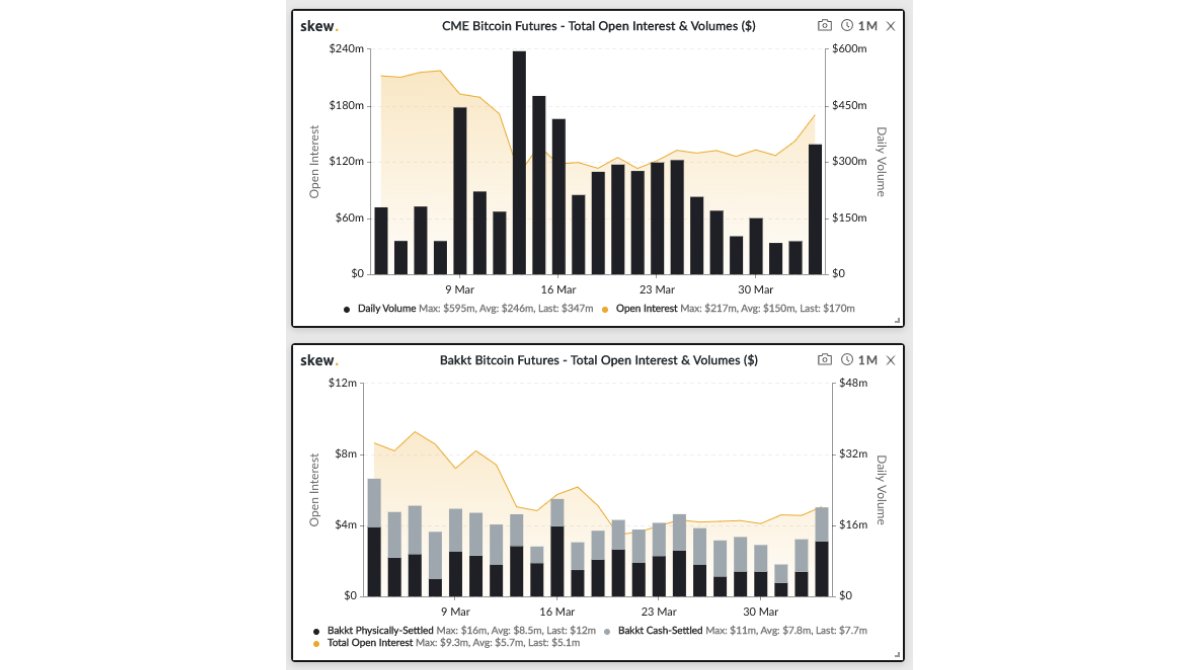

Bitcoin futures traded on the Chicago Mercantile Exchange (CME) also attract more attention of investors. Last week, on 2 April, the trading volume of bitcoin futures on CME reached a three-week high, peaking at $347 million. On Thursday, open futures positions rose to $170 million, reaching the highest level since 11 March.

The institutional investors demonstrate growing interest in cryptocurrency-based derivatives. The volume of bitcoin-pegged derivatives began to grow in the fourth quarter of 2019. However, the all-time high of this indicator is still far away. It reached its historical maximum in February 2019, when trading volume on CME jumped to $1.1 billion.

The trading volume of bitcoin futures also jumped on the crypto trading platform Bakkt launched by the operator of the New York Stock Exchange. It grew to $16 million.