BitMEX, once the pioneer of crypto exchanges offering bitcoin futures, still cannot regain its former market share in the market of bitcoin futures.

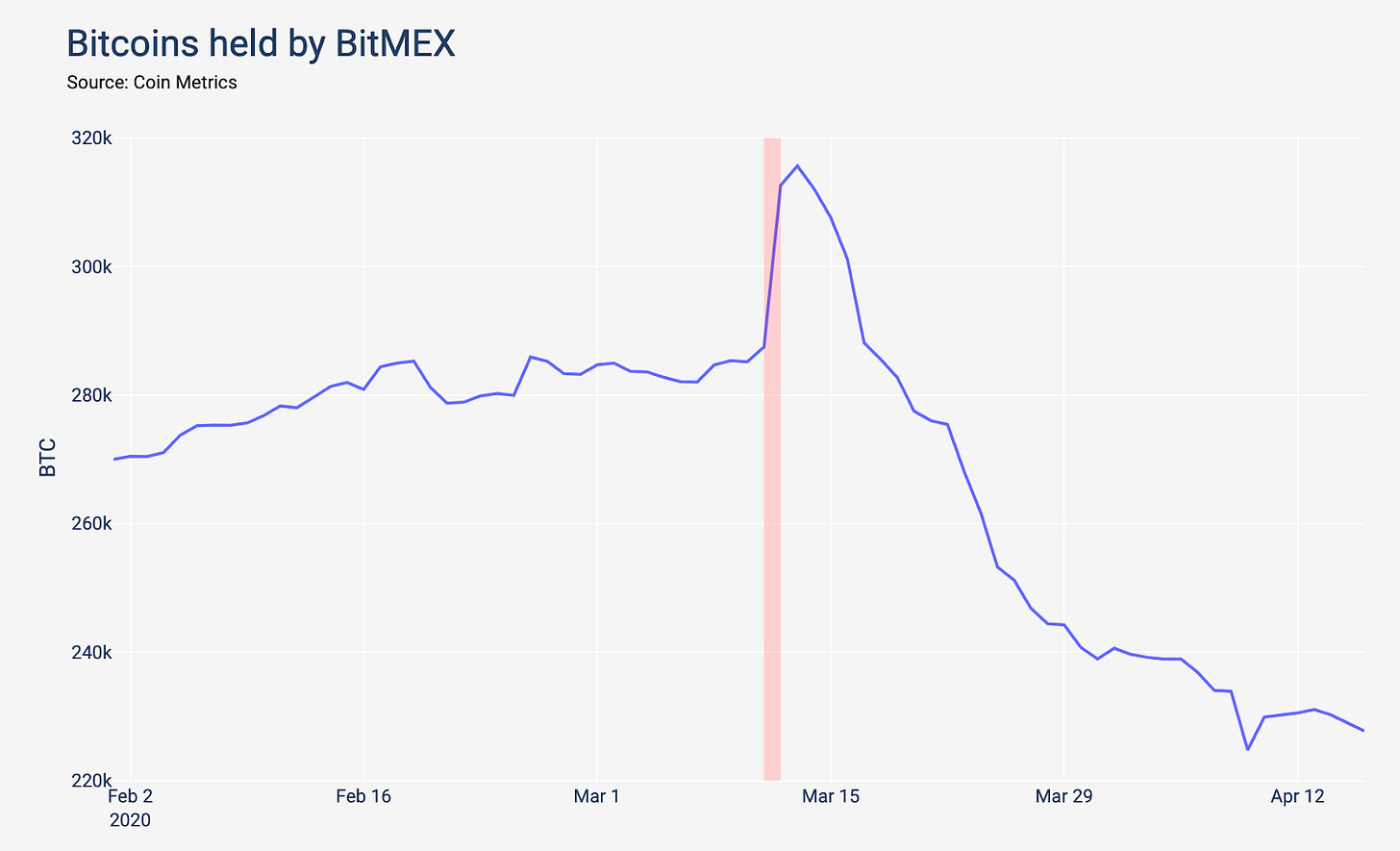

The balance of power in the bitcoin futures market over the past month changed dramatically. The former leader, BitMEX, was never able to recover from the fall in bitcoin prices on March 12, 2020. On that Black Thursday, bitcoin lost in price almost half, and although cryptocurrency has significantly won back since then, the trading volume of bitcoin futures on BitMEX did not return to its previous values.

According to CoinMetrics, the number of bitcoins on BitMEX accounts continues to decline and now stands at just under 220,000 BTC. In early March, this figure was above 280,000 BTC.

The pressure on BitMEX is also exerted by the appearance of competitors in the bitcoin futures market. At the end of March, the world's largest cryptocurrency exchange Binance managed to bypass BitMEX in terms of trading bitcoin futures, although Binance only launched trading of this tool six months ago.

“Notably, since the crash there has been a reshuffling of the top futures marketplaces for crypto assets with BitMEX losing some of its market share to Binance,” Antoine Le Calvez and the Coin Metrics team wrote in their report.

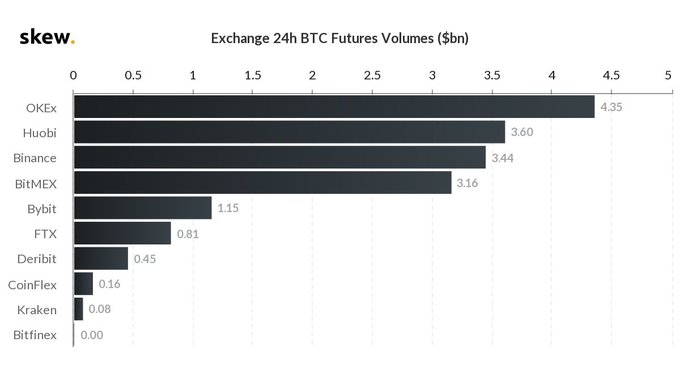

According to the research company Skew, on March 24, the daily trading volume on Binance Futures reached $3.44 billion, which was 8.9% higher than the corresponding figure of the BitMEX crypto exchange.

The world leaders in terms of bitcoin futures trading volume are OKEx and Huobi.