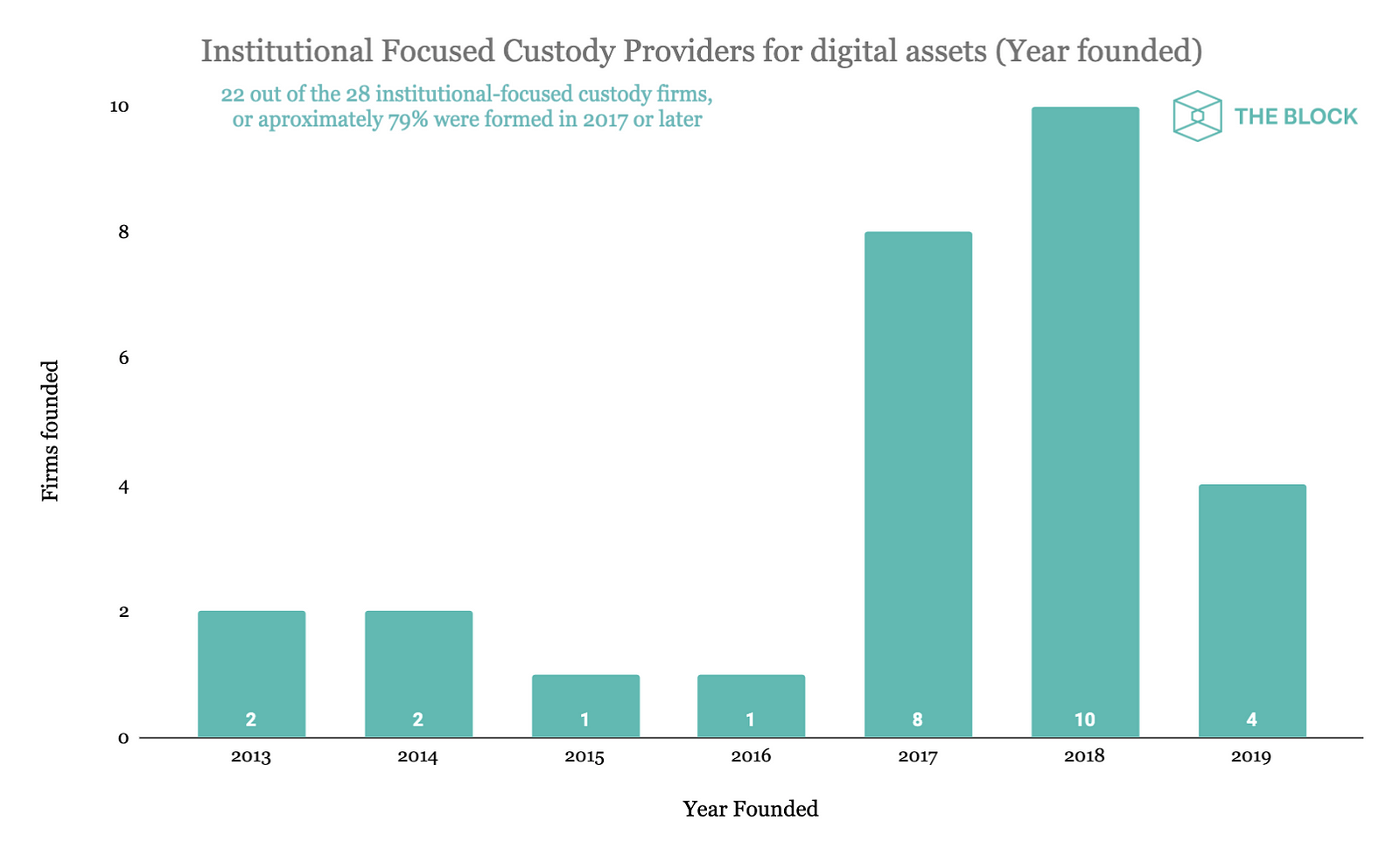

The market digital asset storage services is undergoing a transformational shift. Currently, there are 28 custodian services in the world, 22 of them launched since 2017.

Cryptocurrency companies are developing infrastructure and customer service to meet market demand. One of the trends in recent years is the launch of large custodian services aimed at institutional investors. According to a study by The Block, there are now 28 companies in the world that provide storage services for digital assets to institutions. This list includes Aegis Custody, Anchorage, MaseZero, BitGo, Bakkt, Coinbase, Copper, Crypto Finance, Curv, Fidelity, Fireblocks, Gemini, Hex Trust, Paxos, Kingdom Trust, Knox, Ledger Vault, FirstDigital, Metaco, Onchain Custodian, PrimeTrust, Genesis, Swiss Crypto Vault, Tangany, Koine, Trustology, Unchained Capital, Unbound.

Half of these companies are based in the USA, other three legal entities are registered in Hong Kong, Switzerland and the UK, respectively. Singapore, Israel, Germany, France and Canada have one crypto vault company registered, each one.

Since 2012, these companies attracted $1.6 billion in investment through 46 investment deals. Half of the deals were made in the early stages of company development. 22 out of 28 companies, or roughly 79%, were launched in 2017 or later.

A possible explanation for the high concentration of crypto vaults in the United States may be that the bulk of potential customers feel more comfortable and are familiar with the rules and regulations of the US jurisdiction.