The cryptocurrency market continues to break records. November 2020 demonstrated a sharp surge in trading volumes on crypto exchanges due to the arrival of institutional investors.

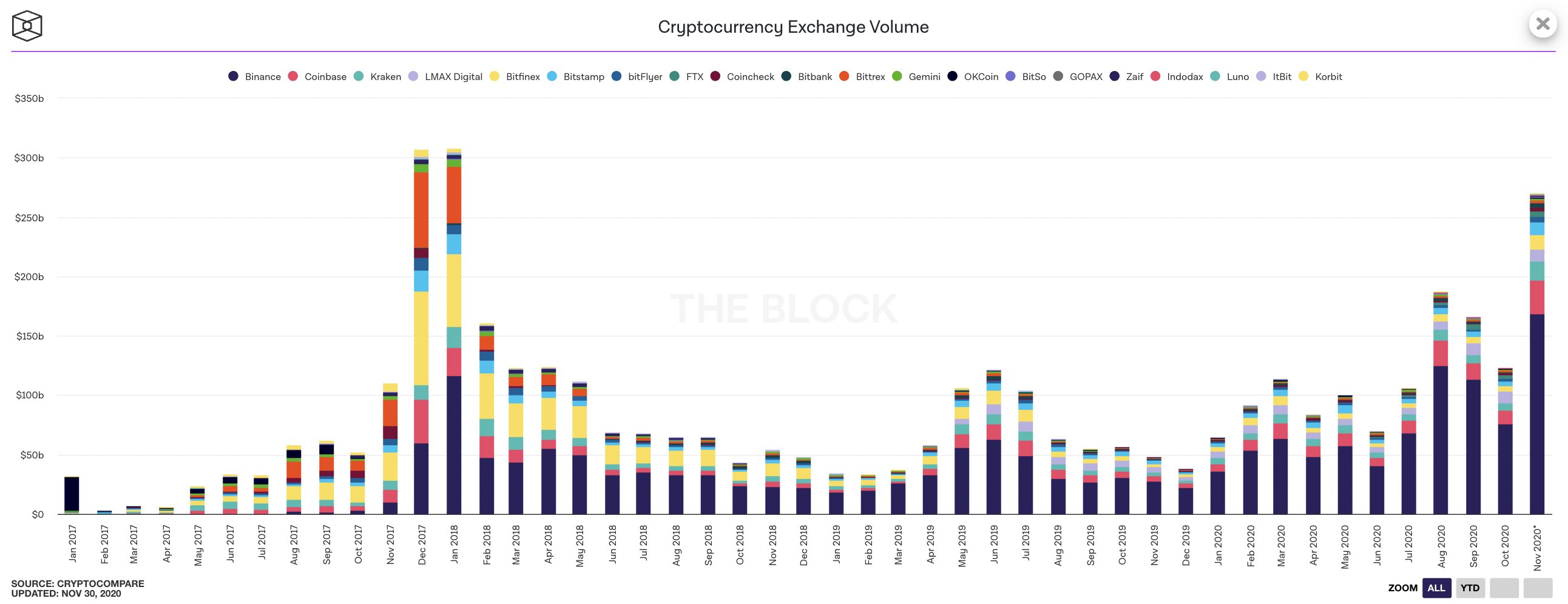

November 2020 became the third month in the history of cryptocurrencies in terms of trading volumes on exchanges, Larry Cermak, an analyst at The Block, discovered. The trading volume approached $280 billion (Binance accounts for $170 billion). And the month is not over yet. January 2018 remains the leader, when the trading volume on crypto exchanges reached $308 billion in US dollar terms. December 2017 with $307 billion stands on the second line. But if the trend continues, upcoming December 2020 may become the most active month in terms of trading volume in the entire history of the crypto market.

As the trading volume on centralized crypto exchanges grows, similar indicators on decentralized trading platforms have been steadily declining since September. If in September the trading volume reached $26 billion, then by November it dropped to $15 billion (Uniswap accounts for $9 billion).

The growth in trading volume is associated not only with the increased volatility of cryptocurrencies and the growth of the bitcoin price, but also with the arrival of institutional investors on the crypto market. Last week, Grayscale bought over 7,300 bitcoins, which is more than $135 million at the current exchange rate. On November 27, investment firm Guggenheim Partners filed an application with the US Securities and Exchange Commission (SEC) asking for permission to invest up to 10% of their Macro Opportunities Fund in the Grayscale Bitcoin Trust (GBTC). Macro Opportunities Fund manages assets worth about $5 billion. Thus. Thus, investments in GBTC could amount to approximately $500 million.